A lot of digital analytics focuses on direct response (conversions, leads, etc.). But there is an additional valuable, and sexy, focus of our marketing we don't give enough analytical love: Branding!

A lot of digital analytics focuses on direct response (conversions, leads, etc.). But there is an additional valuable, and sexy, focus of our marketing we don't give enough analytical love: Branding!It is sad that we spend so little time on brand analysis, primarily because 1. there is such little accountability to brand marketing and 2. it is such a strategic part of any business.

So let's fix that problem in this blog post. Let's become BFFs with a lovely hidden gem that helps you leverage one of the largest source of data on the planet to understand the strength of your brand over time.

[Bonus One: Read: Brand Measurement: Analytics & Metrics for Branding Campaigns]

There are many different tools, both online and offline, that measure the elusive metric called brand strength. It's elusive because brand strength is, at its core deeply qualitative and none of us measurement types can really see inside your hearts and draw charts of the evolution of what's in your heart over time. So we use proxies, and we do the best we can.

One of my favorite tools to do that is Insights for Search which provides an incredible way to see how interest in your brand has grown over time and whether you are strengthening your brand over time.

Brand Strength via Unaided Brand Recall

Insights for Search sits on top of all of Google's organic search data from around the world. I believe it is one of the best possible ways to measure what humanity is thinking, and telling us via the queries they run on Google. I love using this tool to measure "unaided brand recall ."

The stronger your unaided brand recall, the more likely people recognize you, think of you, consider you when they need what you have to offer. I never search for a sports car. I search for the "best Nissan sports car."

You increase unaided brand recall by creating great products (its not called a tablet, they are all called iPads), delivering fantastic service ("their return process is as good as Zappos"), and of course online and offline advertising.

Sometimes it all works together. Recently I saw a TV ad by eBay for designer jeans. I typed designer jeans into Google (for that is what people do when they watch TV). The first ad was for Amazon. No eBay PPC ad or SEO listing showed up. Clever Amazon tying its online advertising with a competitor's offline advertising. Now I search for "amazon designer jeans." :)

For your brand Insights for Search provides an incredible way to see how your brand has grown over time, and whether you are strengthening your brand. If you strengthen it, you drive people to look for you (and not your competitors), and you can capture them more easily using Search (Organic or Paid). Brand queries, obviously, also convert better.

Leveraging Google Insights for Search

So over time, how's your brand doing?

Step 1: Type your brand name, and your direct competitor, into the Search Terms area of Insights for Search .

Step 2: Pick the right country, time period, and -this is important – high-level category in which your brand belongs.

Step 3: Click Search.

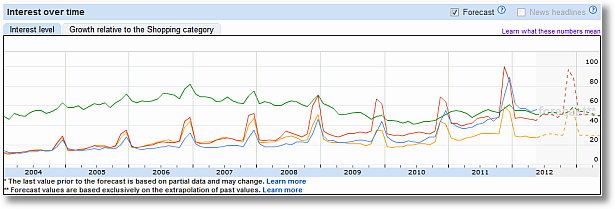

Step 4: In the middle of the resulting report you'll see a trend that looks like this:

This shows the number of searches for your brand, relative to the total number of searches done on Google over time (for the geographic region and time period you've chosen). The data you see is normalized and presented on a scale from 0-100.

This is interesting. You can see that eBay (green) rose for a while but has been essentially flat. During the same time period Walmart (red), Amazon (blue) and Target (orange) have done exceptionally well.

But (as every Analysis Ninja knows) competitive context (above) is good, but industry/category context is even better! So…

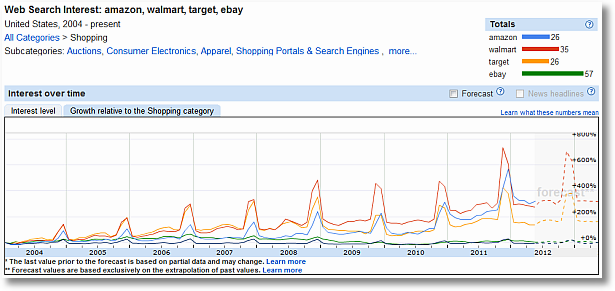

Step 5: Click on the tab that reads "Growth relative to the Shopping category" and boom!

This is a lot more interesting. [Click on the above image for a higher resolution version.]

The graph shows the change over time, starting in Jan 2004. On the right axis you can see how each brand has grown over time in terms of its brand strength, in context of the growth of the Shopping category.

It is pretty amazing to see that even as eBay has massively ramped up its offline (including big TV) advertising, at least in this context its growth (unaided brand recall) has actually lagged its competitors quite a bit.

eBay's green line is very close the performance of the category (and you'll see that often at peaks in the shopping category queries, eBay actually does worse starting holiday season 2009).

The tussle between Wal-Mart and Target is interesting. It used to be cat and mouse, but over the last three years Wal-Mart is clearly leaving Target in the dust (just look at that spike during this past holiday season, omg!).

Amazon is an interesting example. It used to fall behind lag the other two in brand queries, but you can see how starting late 2009 (bad year for Target in this context) Amazon overtook Target and now (2011, 2012) is casting a big shadow over Target. For a real appreciation of how amazing this accomplishment is, consider the TV ads Target runs, the number of Saturday mailers it sends out, the number of billboards it buys, etc.

The above trend lines, when viewed in context of your category, helps you understand how well you are doing in terms of increasing your brand strength.

Do this analysis for your company.

Brand strength is important because when I type "ebay big screen tv" in the search field, I essentially eliminate everyone else. If I type in just "big screen tv", I'm going to Amazon (they just rank so well).

Brand strength is built over time using online and offline advertising. Brand strength is not built by playing a "let's bid on just our brand terms" strategy, but by complementing that strategy with a super-smart organic and paid "let's capture all our brand and category terms" strategy.

[Bonus Two: Video: Enhancing Brand Strength (and Avoiding Brand Destruction) via Social Media]

"Timing The Market"

One thing about Amazon looked particularly interesting to me.

You'll notice that Amazon's Christmas peak comes a few weeks after Walmart and Target. See if you can notice it here:

For Walmart (red) and Target (orange) this is not surprising. These are traditional retailers who have a fixed calendar of marketing execution with an overwhelming emphasis on Thanksgiving. After that, things ramp down.

Traditional retailers often have a fixed multi-channel schedule based heavily on past traditional media plans with less flexibility in being able to incorporate real time odd trends on the web.

But look at Amazon (blue), keep an eye on the highlighted time period above and look at this:

Notice they hit their peak exactly at a time when the Shopping category hit its peak! +25% in the first image above and +37% in one immediately above.

Amazon does such a great job that their brand queries also get an extra spike during that time, from +413% to +525%. You have to hand it to the Marketing folks at Amazon. When their competitors are ramping down (perhaps due to their inflexibility), Amazon can read the market much better (notice Christmas 2010 as well) and are well placed (thanks to Paid and Organic Search strategies) to grab all these new people who are coming into the market to shop.

And precisely at that time both their large competitors are rapidly ramping down their spend! You would think that with actual stores they would ramp up during December because Amazon is at a disadvantage having to use shipping!

Here's the link that should take you directly to the analysis in the images you've seen in this post: http://goo.gl/JbUzK

#rockbranding

Data? Check. Actions?

So what can you do with this data? How can you go and destroy your competitors? :)

I've written a comprehensive post with very specific guidance on how to leverage Insights for Search to identify actions. Please check out that post here: Competitive Intelligence Analysis: Google Insights for Search

In context of the above findings, I would focus on trying to identify the geographic locations in which unaided brand recall is stronger for my competitor(s) compared to me. I would use online and offline brand marketing campaigns to shore up my brand strength.

I would also focus on the very bottom of the Insights for Search report where you are able to see the cluster of search queries most closely associated with a brand (on the left), and the most statistically significant rising terms (on the right). They are full of specific insights you can use to optimize your online search campaigns.

Please check out the blog post above for more detailed guidance.

Five Caveats!

Life would be so much better if we did not have to caveat everything. But, sadly the life of an Analyst is imperfect. :)

Here are some caveats to keep in mind when you do this analysis…

1. This is just data from Google.com. So it just reflects what is happening with the share of people who use Google.com to find what they are looking for.

If I were doing this analysis in Russia I'd be using Yandex, in China I'd use Baidu, etc.

2. This type of analysis works best for medium to large brands. If you are managing a small brand, this might not be an optimal way to understand your brand strength. (Primarily a function of how this data is collected and processed.)

3. These are just brand queries. It is possible that brand zebra is really horrible at getting people to think about their brand, but they are so magnificent and awesome at getting people to visit their site via generic and long-tail queries.

Or you might hear brand zebra say "no one goes to Google since we primary use TV for advertising, they all go to our website directly." Or they might say "everyone in the world has bookmarked our site, no one would go to Google."

All good points.

To account for these objections/scenarios an Analysis Ninja should get additional context for the brand strength analysis done using Insights for Search. You already have the search behavior data, go get the overall traffic picture from a competitive intelligence tool.

I recommend running a report like this one:

I'm using www.compete.com above. You can see how this graph is wonderful context for what you did above with Insights for Search. Now you can answer those objections/scenarios.

4. This is but one (perhaps the most easily accessible) source of data for measuring brand strength. There are other ways to measure brand strength that are also wonderful. Primary market research comes to mind as another solid option.

5. I'm sure I've missed a caveat (this is a dangerous business!), please add your caveats in comments.

As Google Flu Trends has proven, online behavior is a very strong predictor of offline reality. I hope you'll do this analysis for your brand, get context from other data sources, and get your company to take very smart action in moving the dial on brand strength.

As always, it's your turn now.

How does your company measure brand strength/unaided brand recall currently? How cognizant are you of how your competitors are doing? Have you tried to use online data, like Insights for Search, to do this important analysis? What other caveats would you add to the four I've listed above when using this data?

Please share your experience, critique, examples, ideas and feedback via comments.

Thank you.

Excellent Analytics Tips #20: Measuring Digital "Brand Strength" is a post from: Occam's Razor by Avinash Kaushik

ICT4PE&D

No comments:

Post a Comment

Thank's!